In the long run, we're in trouble

The ONS released the latest GDP figures towards the end of September, and I couldn't help but take a look.

Not at the past year, or the period since 2007, but the whole lot.

Since 1949.

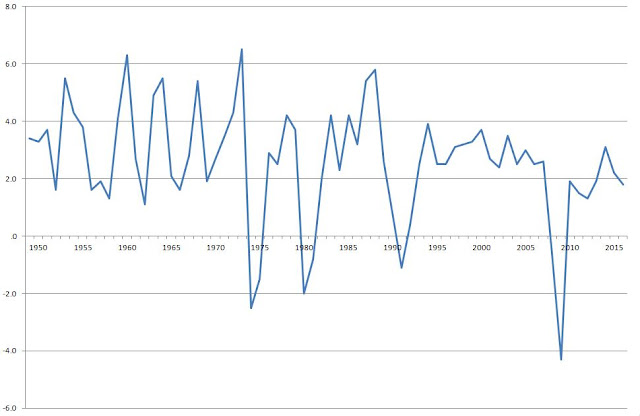

Here it is:

(So. This is annual year-on-year UK GDP growth, in real terms, from ONS IHYP dataset, released 28/9/17)

I have to say I looked at this and immediately saw the trend. (Maybe I've spent too long doing this...) In case you don't see it:

Yup. Downwards. Unremittingly.

This is one of highest quality economic data series available, over a long period of time - nearly 70 years. Irrespective of world events, economic orthodoxy or the political orientation of government, this chart only goes one way.

Structural shift from manufacturing to services? Chronic under-investment (because of the short-term lure of the over-bloated financial sector) reducing the long-term potential for productivity growth? The long slow and inevitable decline of a once-global power?

Or an economy unwittingly moving away from an outdated 'growth' model towards a new, sustainable and steady state? (Intercept, where we can expect GDP to stop growing at all, is about 50 years away...)

Or just a chart?

Whatever. I don't see no magic money tree.

Addendum

Got a bit carried away. What would happen if the pattern of the past continued, as well as the trend? Out to, say, 2050?

Well, roughly matching peak-to-trough patterns, you might impose the pattern from 1964 onwards, in which case you get:

Or, if you prefer the more recent past, the pattern from 1981:

So, not all doom and gloom! Boom and bust abolished in the 2030s!

(Tempted to look at that little flurry of good growth post-2020 and ascribe it to our new-found freedoms post-Brexit? Of course you are: it's a chart.)

Further Addendum

And then, it being the way of the universe, this:

11. Are Ideas Getting Harder to Find?

by Nicholas Bloom, Charles I. Jones, John Van Reenen, Michael Webb - #23782 (EFG PR)

Abstract:

In many growth models, economic growth arises from people creating

ideas, and the long-run growth rate is the product of two terms: the

effective number of researchers and their research productivity. We

present a wide range of evidence from various industries, products,

and firms showing that research effort is rising substantially while

research productivity is declining sharply. A good example is

Moore's Law. The number of researchers required today to achieve the

famous doubling every two years of the density of computer chips is

more than 18 times larger than the number required in the early

1970s. Across a broad range of case studies at various levels of

(dis)aggregation, we find that ideas -- and in particular the

exponential growth they imply -- are getting harder and harder to

find. Exponential growth results from the large increases in

research effort that offset its declining productivity.

Comments